Managing Your Personal Finances

About

There are five areas of Fully Comprehensive Financial Planning: Cash Flow, Investments, Insurances, Legal and Tax. Under the watchful eye of your Trusted Financial Advisor, your team will design your custom written lifetime financial plan, put your plan into action, monitor your plan, and meet with you regularly to keep you on track. This is done to ensure that your financial planning will always be in perfect order and stays that way.

See the videos below about MyBlocks. The software used for comprehensive financial planning that helps ensure all areas of your financial house are in good order.

The Foundation to Your Finances

“It’s not about the money, it’s about the emotions behind the money!” – Peter Catalano

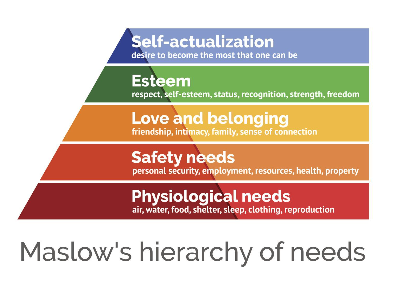

When is comes to money, you spend based on where you are on Maslow’s hierarchy of needs chart on the right. My goal as a trusted advisor is to help you identify your highest core values, in the self actualization level, then provide direction for you to reach that level. When you spend your money based on your self actualized needs, you find fulfillment in life. Works every time.

The Book “Values Based Financial Planning”

The Art of Creating an Inspiring Financial Strategy

Written by Bill Bachrach, this book is an excellent resource for anyone wanting to create a life based on their core values. In the grand scheme of things, money’s not that important. It’s important only to the extent that it allows you to enjoy what’s important to you. And not worrying about your finances is critical to having a life that excites you, nurtures those you love and fulfills your highest aspirations. If you want to make smart choices about money, based on what is important to you—your core values—this book is for you.

This informative and well-written book will help you build a financial strategy, starting with your own unique values—what is truly important to you. By defining these unique values, you can create a plan that not only looks good on paper, but spurs you to follow through and achieve your goals. Click here to order your own copy.

Minding the Gap

Did you know: Women report less confidence in their finances yet are less likely to seek professional help?

We don’t like the idea of women being left behind in their financial goals and objectives. With all the additional challenges that women face in today’s financial landscape, we want to share steps you can take to understand and navigate the obstacles women face.

Click the button to download our whitepaper “Minding the Gap” to see how you can narrow the gap and take control of your finances.

Fascinating

U.S. Financial Literacy Statistics

According to Annuity.org 2022 study, not all Americans feel they are financially prepared.

What is a Certified Financial Planner (CFP)?

The CFP designation remains the most widely known certification for financial planning. It is awarded by the Certified Financial Planner Board of Standards. There are four requirements to receive the designation: education, a comprehensive exam, work experience, and ethics. Here is an explanation of each of the four “E’s”.

The Four “E”‘s

- Education: CFPs receive a rigorous education in financial planning. You must hold at least a bachelor’s degree from an accredited college or university to begin the initial coursework in a CFP Board-approved program. Then you must complete approved courses that cover topics including retirement, estate planning, and insurance. The education doesn’t stop once you’re certified. To maintain the certification, you must complete continuing education (CE) programs every two years.

- Exam: After the education portion, you must take a CFP exam. This exam stretches over a few days and covers financial planning, professional conduct and ethics. Passing this exam shows that you’re qualified to develop financial plans, provide useful recommendations and handle client-advisor relationships.

- Experience: You must also have three years of experience in the finance industry to be eligible to earn this certification. This level of experience shows that you know the ins and outs of the industry, rather than just the general idea.

- Ethics: Lastly, the ethics requirement consists of a background check and a standards code. Before granting you the certification, the board reviews any potential violations, like previous misconduct. This is to ensure that you adhere to the standards of the CFP Board. Being able to follow the rules of conduct and exhibit professionalism are keys to being a successful financial advisor.

What is a Chartered Financial Consultant (ChFC)?

In 1982, the ChFC designation was introduced as an alternative to the CFP designation. It’s awarded by the American College of Financial Services in Bryn Mawr, Pennsylvania. The ChFC is less known than the CFP, but still stands as a distinguished certification in financial planning. The biggest difference between the two is the process of becoming certified.

The education portion for a ChFC is lengthier, comprising nine college-level courses. But at the core, it is a similar education to the CFP education. Courses focus on financial planning, covering topics like investing, insurance planning, and retirement planning. There are also courses that focus on planning with different types of clients, such as divorcees or special needs families.

These courses are self-paced and can be done online. There is no final, comprehensive exam, as there is for the CFP designation. Instead, you take a final exam at the end of each course.

To enroll in the program, you must have at least three years of experience in the finance industry. Having a degree in finance or business will help you in the courses and can count as one of your years of experience. Again, you must subscribe to a professional pledge and a code of ethics.

OnGoing Education is Key

The Advisor must continue to earn CE credits to maintain the designation. This involves taking courses and participating in programs to keep them current on financial planning practices.

Meeting all of these requirements leads to a ChFC designation. These high standards ensure that a ChFC is prepared as a financial advisor to give knowledgeable and helpful advice that suits clients’ needs. In turn, clients will be assured that an advisor with this designation knows what they’re talking about.

Bottom Line

From a client standpoint, the differences between a ChFC and CFP are minor. Even with the educational differences, they are fairly similar in practice as financial advisors. Both still require extensive education and experience that prepares advisors to give the best financial advice. So, when it comes to choosing an advisor, it is better to judge an advisor on an individual basis, rather than based on which one of these two designations the advisor holds.

Peter Catalano received his Chartered Financial Consultant designation in 1999 and his Chartered Life Underwriter designation in 2001. He continues to hold the designations by completing the required continuing education and ethics training every two years.

Ready to Hire a Financial Advisor? Contact Me Today

You can easily utilize the MyBlocks software for your financial planning. For more in-depth analysis and to keep yourself held accountable, consider hiring me as your financial advisor. I would be happy to explore the options with you. Click below to set an initial phone appointment.